How UK Investors Can Get a UAE Golden Visa?

For UK investors, Dubai and the UAE have become some of the world’s most attractive destinations for both real estate investment and long-term residency. With high rental yields, strong capital appreciation, and a tax-free environment, the UAE offers British citizens a unique opportunity to diversify their investment portfolios while enjoying the benefits of a stable and business-friendly economy. Cities like Dubai and Abu Dhabi are known for their world-class infrastructure, luxury developments, and thriving expat communities, making them ideal for both lifestyle and financial growth.

In recent years, the UAE government has introduced initiatives to encourage foreign investment, with the Golden Visa Program standing out as a major incentive. This long-term residency scheme is designed for investors, entrepreneurs, and skilled professionals, offering up to 10 years of residency without the need for a local sponsor. For UK property investors, the Golden Visa is particularly appealing, as it allows them to combine property ownership with residency benefits, including the ability to live, work, and study in the UAE alongside family members.

This guide aims to provide UK investors with a clear roadmap on how to qualify for a UAE Golden Visa through property investment. We will cover eligibility criteria, the step-by-step application process, required documents, and the long-term advantages of obtaining this residency. By the end, British investors will have a thorough understanding of how to leverage UAE property investments not just for financial returns, but also for lifestyle, security, and global mobility.

WHAT IS THE UAE GOLDEN VISA?

The UAE Golden Visa is a long-term residency permit designed to attract foreign investors, entrepreneurs, and highly skilled professionals. Unlike standard visas, it allows recipients to live, work, and study in the UAE without a local sponsor, offering independence and security for both individuals and their families.

- Launched: 2019

- Duration: 5 or 10 years, renewable

- Target Audience: Investors, entrepreneurs, skilled professionals

- Special Option for Property Investors: 10-year Golden Visa

The program was introduced as part of the UAE government’s strategy to attract high-value global talent and investment, strengthen the economy, and support long-term development projects. For property investors, the Golden Visa combines high-value investment with long-term residency in a fast-growing, cosmopolitan market.

WHY UK INVESTORS ARE CHOOSING UAE PROPERTY:

Dubai and the UAE have become a top choice for UK investors looking to combine high-return property investments with long-term residency benefits. The region offers unique advantages that make it stand out from traditional markets like London or Manchester. Here are the main reasons:

- Tax-Free Income – No income tax or capital gains tax on property investments.

- Currency Advantage – With a strong pound sterling, UK investors gain better purchasing power in AED.

- High Rental Yields – Dubai offers 5–8% average rental returns, higher than London’s 2–4%.

- World-Class Lifestyle – Safety, luxury, and global connectivity.

- Long-Term Residency – Golden Visa gives 10 years of peace of mind, including for family members.

GOLDEN VISA ELIGIBILITY THROUGH PROPERTY INVESTMENT

To qualify for the Golden Visa as a property investor, UK citizens must meet the following UAE government criteria:

| Requirement | Description |

|---|---|

| Minimum Property Value | AED 2 million (approx. £440,000) |

| Ownership Type | Property must be owned by the applicant (not rented) |

| Property Status | Can be ready or off-plan if from an approved developer |

| Financing | Mortgaged property is acceptable, but equity must be AED 2M+ |

| Ownership Duration | No minimum period, but property must remain owned during visa validity |

| Eligible Locations | Any emirate – Dubai, Abu Dhabi, Sharjah, Ras Al Khaimah, etc. |

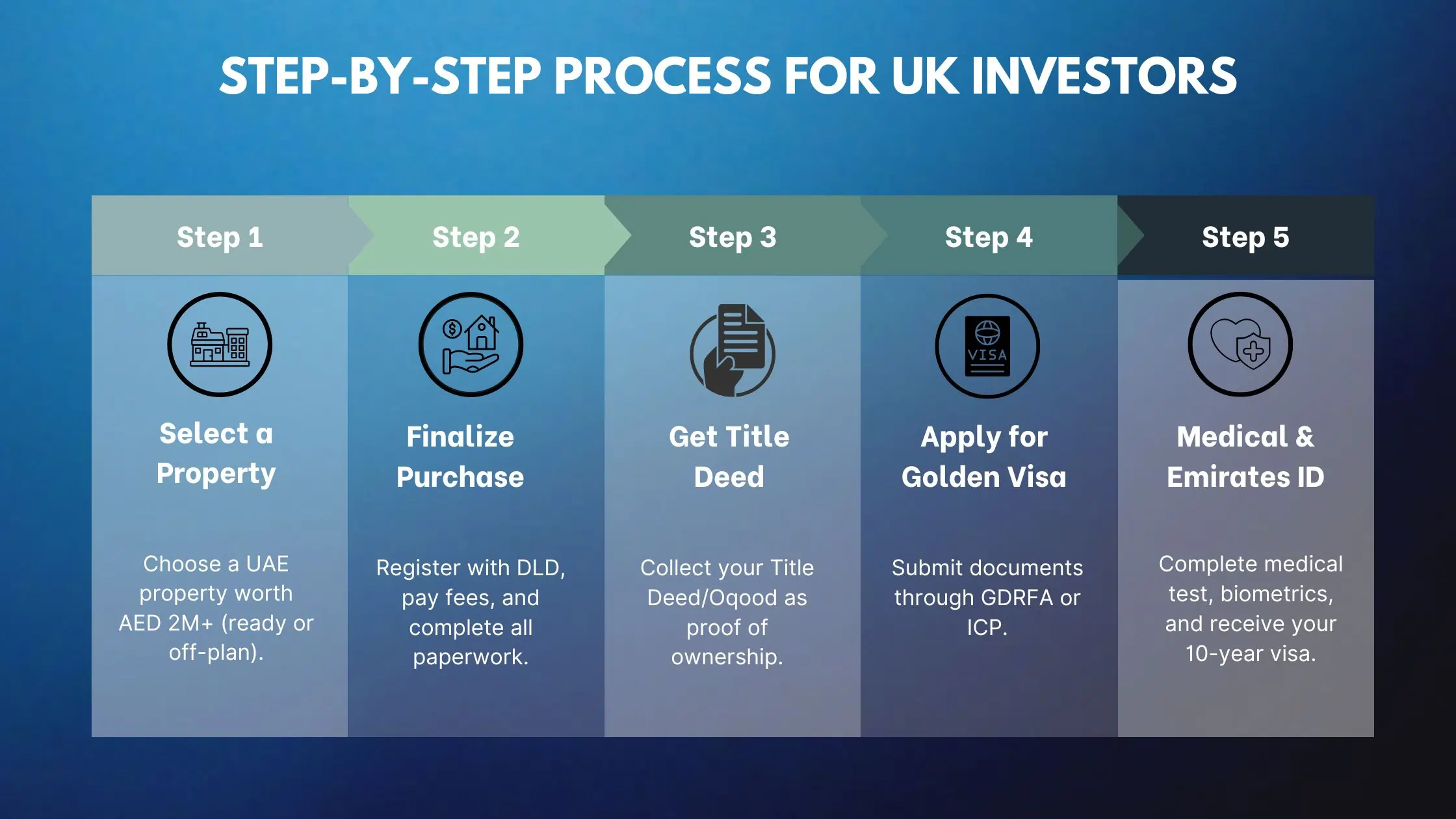

STEP-BY-STEP PROCESS FOR UK INVESTORS

UK investors looking to secure a UAE Golden Visa through property investment need to follow a structured process to ensure eligibility and a smooth application. Below is a detailed, step-by-step guide:

STEP 1: CHOOSE A QUALIFYING PROPERTY

- Select a property worth AED 2 million or more — this can be ready-to-move-in or off-plan.

- Popular and approved developers include Emaar, DAMAC, Sobha, Nakheel, and Ellington.

- Consider factors such as location, rental potential, property type, and long-term appreciation to maximize both investment and visa benefits.

STEP 2: COMPLETE THE PROPERTY PURCHASE

- Register the sale with the Dubai Land Department (DLD) or the relevant authority in the emirate where the property is located.

- Pay applicable fees, typically 4% of the property value, along with any registration charges.

- Ensure that all legal documents are correctly signed, notarized, and verified to avoid delays in visa eligibility.

STEP 3: OBTAIN THE TITLE DEED

- Once the purchase is finalized, collect your Title Deed (or Oqood certificate for off-plan properties).

- The title deed serves as official proof of property ownership, which is mandatory for a Golden Visa application.

STEP 4: APPLY FOR THE GOLDEN VISA

Submit your application through:

- GDRFA (Dubai) – General Directorate of Residency and Foreigners Affairs

- ICP (Abu Dhabi) – Federal Authority for Identity and Citizenship

Many developers also provide in-house support for visa processing, helping investors navigate document submission and approvals. Ensure that all required documents, including a passport copy, title deed, and proof of payment, are complete.

STEP 5: MEDICAL TEST & EMIRATES ID

- Complete a medical fitness test at a government-approved center.

- Undergo biometric scanning and apply for your Emirates ID.

- Once approved, your Golden Visa is stamped in your passport, granting 10-year residency for you and eligible family members.

DOCUMENTS REQUIRED

To apply for the UAE Golden Visa through property investment, UK investors must provide a set of official documents that verify both their identity and property ownership. For mortgaged properties, proof of AED 2M equity from the bank must also be included. Ensuring that all documents are complete and accurate is crucial for a smooth application process.

- Copy of UK passport (valid for at least 6 months)

- UAE property title deed or Oqood certificate

- Sale & Purchase Agreement (SPA)

- Payment receipts or bank statements confirming ownership

- Property valuation certificate (if requested)

- Recent passport-size photographs

- Health insurance and medical test certificate

- Emirates ID application receipt

VISA VALIDITY AND RENEWAL

The UAE Golden Visa offers long-term residency for property investors, providing security and stability for UK nationals and their families. Understanding the validity and renewal process is essential for planning both residency and investment strategy.

- Duration: Typically 10 years for property investors.

- Renewal: Can be renewed as long as the property ownership criteria are maintained.

- Family Sponsorship: Includes spouse, children, and dependents, providing full family residency benefits.

- Property Ownership Requirement: The investor must continue to own the qualifying property for renewal eligibility.

- Documentation for Renewal: Updated property proof, passport copies, and any changes to family dependents must be submitted.

UK VS UAE PROPERTY MARKET: A COMPARISON FOR INVESTORS

For UK investors considering UAE property, it’s important to understand how the UAE market compares with the UK market in terms of returns, taxation, and lifestyle benefits. Below is a detailed comparison:

| Feature | UK Property Market | UAE Property Market |

|---|---|---|

| Income & Capital Gains Tax | Rental income and capital gains are taxable (20–28% in some cases). | Tax-free on both rental income and property appreciation. |

| Rental Yields | Average yields in London: 2–4%. | Dubai offers 5–8%, depending on location and property type. |

| Property Prices | Higher entry costs for prime areas (London, Manchester). | Competitive pricing relative to international standards; high-value properties accessible with strong ROI potential. |

| Residency Options | UK property ownership does not grant residency. | Eligible property investment can lead to a 10-year Golden Visa for the investor and family. |

| Lifestyle & Infrastructure | Established infrastructure; cultural and historical advantages. | Modern infrastructure, luxury lifestyle, safety, and world-class healthcare and education. |

| Currency Advantage | N/A | Strong GBP vs AED allows UK investors greater purchasing power. |

| Market Growth Potential | Moderate growth; slower appreciation in established cities. | High growth potential, especially in Dubai and Abu Dhabi; premium areas show strong capital appreciation. |

| Legal & Regulatory Environment | Well-regulated with strong legal protections for buyers. | UAE offers a transparent legal framework, especially for foreign investors, with approved developers and property registration authorities. |

TOP AREAS FOR UK INVESTORS IN THE UAE

Choosing the right location is crucial for maximizing both property returns and Golden Visa eligibility. Here are the most attractive areas in the UAE for UK investors:

Downtown Dubai

- Iconic location featuring Burj Khalifa, Dubai Mall, and Dubai Opera.

- Offers a mix of luxury apartments and penthouses with strong rental demand.

- Ideal for investors seeking high capital appreciation and a cosmopolitan lifestyle.

Dubai Marina

- Popular waterfront community with high expatriate rental demand.

- Features luxury apartments, yachts, and leisure amenities.

- Strong rental yields of 6–8%, making it attractive for income-focused investors.

Palm Jumeirah

- Exclusive island community offering villas, townhouses, and luxury apartments.

- Known for a high-profile lifestyle and prestige, it appeals to international investors.

- Offers long-term appreciation and premium rental income opportunities.

Business Bay

- Central business district with excellent connectivity to Downtown Dubai and Sheikh Zayed Road.

- A mix of commercial and residential properties, suitable for rental and capital growth.

- Ideal for investors looking for professional tenant markets and corporate rentals.

Jumeirah Village Circle (JVC)

- Affordable yet strategically located for families and young professionals.

- Off-plan and ready properties above AED 2 million qualify for the Golden Visa.

- Growing community with potential for strong future capital appreciation.

Abu Dhabi – Saadiyat Island

- Premium beachfront properties with luxury resorts, cultural institutions, and high-end amenities.

- Offers steady rental demand and long-term growth potential.

- Ideal for UK investors seeking diversification outside Dubai.

KEY BENEFITS FOR UK PROPERTY INVESTORS

- Long-Term Residency – Stay for up to 10 years, renewable.

- No Local Sponsor Required – Full independence for living and investing.

- Family Sponsorship – Include spouse, children, and support staff.

- Business Ownership – 100% ownership rights for companies in the UAE.

- Easy Travel – Multiple-entry visa; maintain residence without annual renewal.

- High-Value Investment – Combine property appreciation with strong rental returns.

- Healthcare & Education Access – Use the UAE’s premium medical and schooling systems.

WHY CHOOSE AVANTEX

Partnering with Avantex makes the Golden Visa process seamless for UK investors. They provide end-to-end support, guiding clients from property selection to the visa application, while ensuring all legal and compliance requirements are fully met for a smooth and hassle-free process. Avantex Business setup consultants also offers portfolio optimization, helping investors align their property choices with both Golden Visa eligibility and long-term ROI goals. With trusted guidance and expert advice on top areas and high-demand properties, Avantex ensures that clients make informed decisions. Whether you are looking for luxury apartments in Downtown Dubai, waterfront properties in Dubai Marina, or premium villas on Palm Jumeirah, Avantex can direct UK investors toward the best opportunities for residency, lifestyle, and long-term wealth growth..